VA Loan Rates Today Current VA Mortgage Interest Rates

Table of Content

Many times, lenders who pay off traditional mortgages ahead of schedule are subject to a fee. These kinds of mortgages are known as prepayment penalty mortgages, or PPMs. A great advantage of a VA home loan is that there is no penalties or fees for paying off the loan ahead of time.

The funding fee rate for VA-backed refinanced loans doesn't change based on your down payment amount. If you purchase a manufactured home, you also only need to pay the first-time use funding fee rate. The price is the amount you paid for a home or plan to pay for a future home purchase. Buying a home with a lower purchase price can help lower the monthly mortgage payment. Enter your home price into the VA loan payment calculator above. As the name implies, the VA home loan program is reserved for veterans and active members of the United States military.

Debt Payments

To get the most accurate estimate, calculate your interest rate conservatively. If you estimate your interest rate too low, you might be disappointed when you lock in your rate. If you aren’t sure, call a VA lender to ask for more personalized interest rate information.

Be sure to evaluate your financial situation before making any prepayments. Considering the pros and cons, for anyone who can qualify, VA loans are often the best option. This is especially true for those exempted from VA funding fee and those who plan to put little or no down payment. When comparing the VA loans with another loan, the VA funding fee is the key. Make sure the VA funding fee to be paid is outweighed by the benefits from the VA loan.

VA Home Loans: Top Benefits And Advantages

On August 1, 2019 Ginnie Mae announced they were lowering the loan-to-value limit on cash out refinancing loans to 90% LTV. Qualify - First, you need to make sure that you are actually qualified to receive a VA home loan. Look over the eligibility requirements as outlined in the previous section. If you are still unsure about whether or not you qualify, you should use the Veteran Affairs Eligibility Center to see what they have to say.

Since the VA guarantees a part of the loan, lenders are able to provide it at a lower interest rate. Adjustable-rate mortgages are home loans with varying interest rates. Initially, the interest rate remains constant; however, after the initial term, the loan resets, and so does the loan interest. According to the amendments made in 2020, VA loan limits are no longer applicable to a person with full entitlement.

Refinancing with Veterans United Home Loans

The fee changes to 3.6% on any future VA purchases or Cash-Out refinances. VA Streamline refinances, also known as IRRRLs , carry a reduced funding fee of 0.5%. The VA Funding Fee is charged by the Department of Veterans Affairs to keep the VA loan program running for future military homeowners. A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. Customers with questions regarding our loan officers and their licensing may visit the Nationwide Mortgage Licensing System & Directoryfor more information.

Still, the limit in most areas is currently $729,000; for the vast majority of people, that amount is more than enough for what they are looking at. VA refinance rates are often different than rates on VA purchase loans. The type of VA refinance loan, the borrower's credit score, the loan-to-value ratio, and other factors can all play a role in VA refinance rates.

Take advantage of your military benefits today with a $0-down VA loan from Veterans United. Veterans United is the nation's #1 VA home purchase lender & has originated over $10.2 billion in home loans since 2017. There is no mortgage insurance involved, relieving VA loan borrowers of a big expense.

The funding fee increases after every subsequent use of VA loan benefits. You will pay more in funding fees the second time you borrow a loan. Your mortgage payment includes the principal, interest, funding fees , taxes, and insurance premiums. A VA funding fee is a one-time payment made to the Department of Veterans Affairs to support the VA loan program.

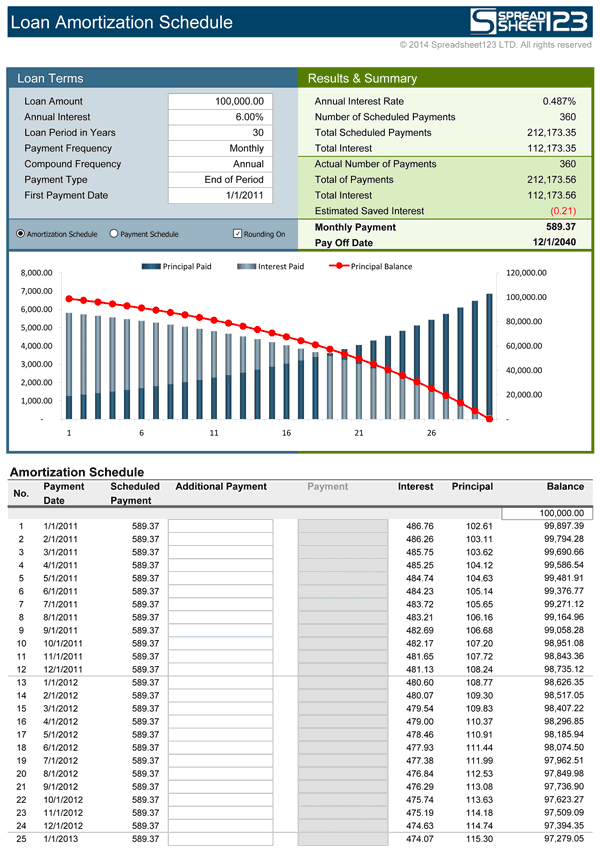

Simply enter the purchase price of the home, your down payment and details about the loan to calculate your VA loan payment breakdown, schedule and more. As noted previously, the interest rates for VA home loans are generally quite a bit lower than for traditional mortgage products. In fact, this is one of their major selling points and is the main reason why so many people are sold on them. For people with poor credit, especially, the low interest rates offered through the VA home loan program are very enticing.

A downpayment is an amount you pay upfront while financing against an asset. VA home loans are mortgage opportunities that do not require you to pay anything upfront, even if your credit score is a little shaky. Choosing to refinance an existing loan into a VA loan can cost more than borrowing a VA purchase loan.

Comments

Post a Comment